We are all surrounded by data. In our daily lives, from the morning commute to the afternoon water-cooler conversations, there exists a wealth of data in the world around us. Data is one part in a hierarchy of ways to think about and interpret the world around us. Unto itself, individual data points have no meaning. It is only with analysis that information, which is data that is used to make decisions, can be derived. This decision-making lends us knowledge, which is the goal of informed decision-making. By being able to interpret and synthesize the data available in any industry, business owners can take advantage of opportunities.

|

| Knitting Designing is all about turning Data like measurements and stitch counts into information: the finished pattern |

Bristol, (BristolIvy on Ravelry) writes a regular series entitled The Stock(inette) Market where she takes an in-depth look at pattern sales trends based on Ravelry data for a period of time. She aggregates this data, and then provides the analysis to be able to discern trends and areas of growth. This provides savvy designers a starting point for getting an idea of where the market is headed. For example, in her most recent post covering the month of September, she finds that as we head towards the cooler months, neck accessories are the dominant sales driver, along with cold weather accessories such as hats, mittens, and gloves. Gathering this information over a period of time, up to and including years, the savvy statistician can paint a picture of the market, and be able to position themselves to take advantage of publishing patterns at the opportune time.

For TNNA members, the organization offers a wonderful resource in the form of a series of surveys they conduct of all fiber artists on a regular basis. This data consists of a wide range of information, from yarns frequented to number of projects on needles at one time. In addition to being able to demonstrate current trends, the TNNA data is presented in comparison to previous surveys, to show trends over time, a powerful way to look at data to gain insight into the future.

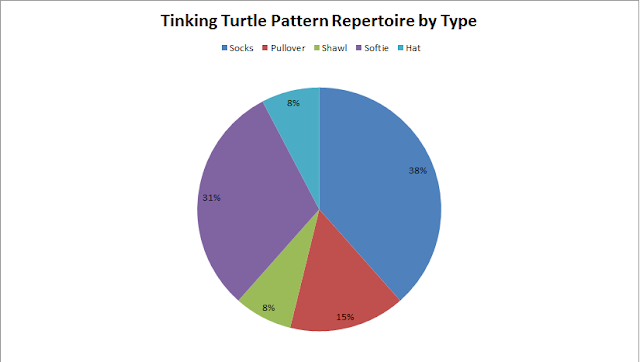

Ravelry itself can be a source of data, such as in the graph below, mined from our Tinking Turtle sales.

|