From the Business Desk

Welcome to the first edition of a semi-regular series that I will be contributing to this site focusing on the business side of running a small fiber arts business. As introduced in the first post I wrote earlier this week, I officially

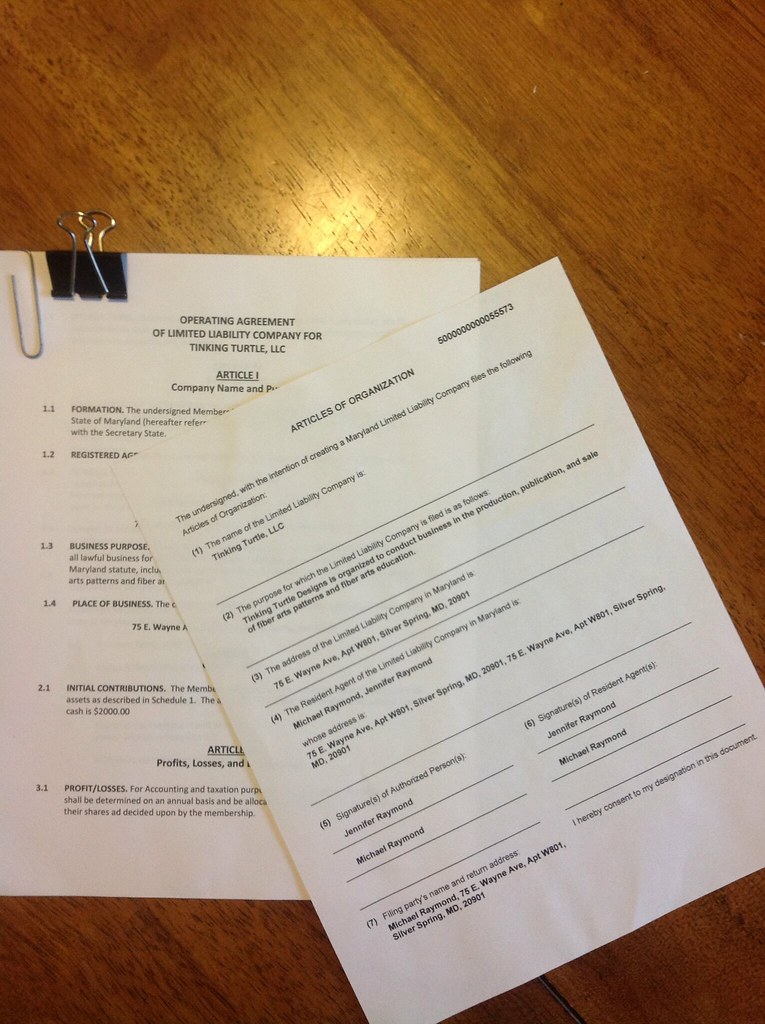

joined the Tinking Turtle team back in August to take on management of the business side of the organization: contract management, accounting and bookkeeping, and strategic/structural planning. I plan on writing monthly topics discussing some of the trials, tribulations, and learning experiences that have come about in the past three plus years as a small business.

For my first topic, I wanted to open the door with an overview of small business organization, as for many business owners, this is the first consideration after making the plunge and deciding you want to start being your own boss.

The most significant difference that a business owner should understand among all levels of organization is that there is a trade off between operational flexibility and protection from risk. As a business owner, this is accomplished by either legally separating your business and yourself into two separate entities, to reduce your individual liability and risk in the event of an issue, or by having you and the business be one and the same to maximize your flexibility and minimize your reporting requirements.

The IRS has a great overview site to discuss how different organizational structures are affected by taxation and reporting requirements. Additionally, a wonderful resource for the crafty type person to begin to explore what option would be best for you is The Craft Artist’s Legal Guide, presented by NOLO.

Please note that the below information is presented as advice only. If you are considering any of these specific options, it is highly recommended that you consult with an accountant or attorney to understand any additional legal ramifications of your decision.

The core business structures a small business would be considering fall into three primary groups: Sole Proprietorships, Partnerships, and Corporations of various types. Sole Proprietorship and Partnerships are considered unincorporated types of business, while the various type of Corporation, explained below, are all incorporated, which means they are legal entities filed within the state of primary operations of the business.

There are no requirements to being operating your business as a Sole Proprietorship at the macro level (certain municipalities may require business licenses, be sure to check with your local licensing board first!); once you start operations, you are operating under this structure. With the Sole Proprietorship, your only structural requirements are to file additional forms with your income tax on an annual basis. The drawback of this level of organization is that there is limited protection from risk as a Sole Proprietor, so you personally can be held accountable for the debts and tax liability of your business.

Partnerships are similar to Sole Proprietorship in that they require little formal reporting outside of an annual report to the IRS. Partnerships are strongly recommended to prepare a formal agreement, to codify some of the responsibilities or distributions, especially if it is not an even split between the applicable parties. Partnerships additionally do not limit individual liability, and in the event of a dispute, all partners and their assets are considered fair game.

The most formal level of organization for a small business is one of many types of Corporations. There are three specific types, all of which exist as stand-alone entities, separate from the business owners: the S Corporation (S-Corp), the C Corporation (C-Corp or what is traditionally referred to as a Corporation) and the Limited Liability Corporation (LLC). The largest difference between these different structures are how corporate taxes are handled; C-Corps are taxed as separate corporate entities with a separate tax governance and structure; S-Corps are what are considered “pass through” entities, where any tax burden is paid by the owners or shareholders. LLCs are a fairly new entity that are governed by state law, and can be organized in multiple ways, but that’s a topic for another post. Any of these forms of corporation are established by incorporating with the cognizant state authority, usually the Secretary of State.

No matter which structure you choose for your business, having a plan for how you want to establish yourself is key to being a successful business owner, and turn the craft hobby that you love into a viable profession.